10 Books Similar to "My Money My Way: Taking Back Control of Your Financial Life"

by Kumiko Love

Debt-Free Forever: Take Control of Your Money and Your Life

"Debt-Free Forever" by Gail Vaz-Oxlade provides a no-nonsense, practical roadmap for eliminating debt and establishing lasting financial stability. Vaz-Oxlade emphasizes tough love and accountability, guiding individuals through creating realistic budgets, prioritizing debt repayment, and developing long-term savings habits. The book outlines specific strategies and tools to confront financial challenges head-on, move past excuses, and ultimately achieve financial independence.

This book shares a core philosophy with Kumiko Love's "My Money My Way" by empowering individuals to regain control of their financial narratives. Both authors advocate for a proactive, intentional approach to personal finance, rejecting passive acceptance of debt and promoting structured planning. They both emphasize actionable steps over theoretical concepts, making financial management accessible and achievable for everyday people.

This book will appeal to anyone feeling overwhelmed by debt or seeking a clear, disciplined path to financial freedom. Its direct language and actionable advice offer a sense of agency, equipping individuals with the tools and mindset necessary to transform their financial lives. The emphasis on practical application and accountability makes it a valuable resource for those ready to commit to significant financial change.

Debt-Free Forever: Take Control of Your Money and Your Life

"Debt-Free Forever" by Gail Vaz-Oxlade provides a no-nonsense, practical roadmap for eliminating debt and establishing lasting financial stability. Vaz-Oxlade emphasizes tough love and accountability, guiding individuals through creating realistic budgets, prioritizing debt repayment, and developing long-term savings habits. The book outlines specific strategies and tools to confront financial challenges head-on, move past excuses, and ultimately achieve financial independence.

This book shares a core philosophy with Kumiko Love's "My Money My Way" by empowering individuals to regain control of their financial narratives. Both authors advocate for a proactive, intentional approach to personal finance, rejecting passive acceptance of debt and promoting structured planning. They both emphasize actionable steps over theoretical concepts, making financial management accessible and achievable for everyday people.

This book will appeal to anyone feeling overwhelmed by debt or seeking a clear, disciplined path to financial freedom. Its direct language and actionable advice offer a sense of agency, equipping individuals with the tools and mindset necessary to transform their financial lives. The emphasis on practical application and accountability makes it a valuable resource for those ready to commit to significant financial change.

Easy Money Management: A Give and Save 3-6-5 Approach to Personal Finance

"Easy Money Management: A Give and Save 3-6-5 Approach to Personal Finance" distills financial organization into a practical, action-oriented system. It guides individuals through establishing sustainable habits for allocating income, emphasizing a "give, save, spend" framework implemented daily, weekly, and monthly (3-6-5). The book focuses on breaking down complex financial concepts into digestible steps, offering tools and strategies for budgeting, debt reduction, and wealth accumulation, all designed for consistent, incremental progress.

This book resonates with the core message of Kumiko Love's "My Money My Way: Taking Back Control of Your Financial Life." Both titles empower individuals to move beyond passive financial worry and actively shape their monetary future. They share a fundamental belief in demystifying personal finance and providing actionable steps for individuals, rather than relying on abstract economic theories. Each encourages a personalized approach to financial health, fostering a sense of agency and control.

Individuals seeking practical, implementable financial strategies will find this book particularly valuable. Its structured "3-6-5" approach offers a clear roadmap for consistent engagement with one's finances, making the often-daunting task of money management feel achievable. The emphasis on habit formation and incremental improvements ensures that even those new to financial planning can build a strong foundation, leading to a greater sense of security and long-term financial well-being.

Easy Money Management: A Give and Save 3-6-5 Approach to Personal Finance

"Easy Money Management: A Give and Save 3-6-5 Approach to Personal Finance" distills financial organization into a practical, action-oriented system. It guides individuals through establishing sustainable habits for allocating income, emphasizing a "give, save, spend" framework implemented daily, weekly, and monthly (3-6-5). The book focuses on breaking down complex financial concepts into digestible steps, offering tools and strategies for budgeting, debt reduction, and wealth accumulation, all designed for consistent, incremental progress.

This book resonates with the core message of Kumiko Love's "My Money My Way: Taking Back Control of Your Financial Life." Both titles empower individuals to move beyond passive financial worry and actively shape their monetary future. They share a fundamental belief in demystifying personal finance and providing actionable steps for individuals, rather than relying on abstract economic theories. Each encourages a personalized approach to financial health, fostering a sense of agency and control.

Individuals seeking practical, implementable financial strategies will find this book particularly valuable. Its structured "3-6-5" approach offers a clear roadmap for consistent engagement with one's finances, making the often-daunting task of money management feel achievable. The emphasis on habit formation and incremental improvements ensures that even those new to financial planning can build a strong foundation, leading to a greater sense of security and long-term financial well-being.

Financial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You Love

"Financial Feminist" by Tori Dunlap directly addresses the systemic barriers and societal conditioning that disproportionately impact women's financial lives. It's a pragmatic guide that empowers women to confront these challenges, offering actionable strategies to build financial independence, navigate investments, and assert control over their money, all while challenging traditional narratives surrounding wealth and gender.

Both books champion a personalized and empowered approach to finances. Like Kumiko Love's "My Money My Way," Dunlap's work emphasizes breaking free from restrictive financial advice and instead developing a system that aligns with individual values and goals. They share a core philosophy of challenging conventional wisdom to foster financial agency.

This book will appeal to those seeking not just financial advice, but also a broader understanding of money within a social context. It offers a powerful blend of practical tools and insightful critique, providing an accessible pathway to financial mastery for anyone who feels disempowered by or disconnected from traditional financial guidance. Its engaging voice and relevant subject matter make it a compelling and valuable resource.

Financial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You Love

"Financial Feminist" by Tori Dunlap directly addresses the systemic barriers and societal conditioning that disproportionately impact women's financial lives. It's a pragmatic guide that empowers women to confront these challenges, offering actionable strategies to build financial independence, navigate investments, and assert control over their money, all while challenging traditional narratives surrounding wealth and gender.

Both books champion a personalized and empowered approach to finances. Like Kumiko Love's "My Money My Way," Dunlap's work emphasizes breaking free from restrictive financial advice and instead developing a system that aligns with individual values and goals. They share a core philosophy of challenging conventional wisdom to foster financial agency.

This book will appeal to those seeking not just financial advice, but also a broader understanding of money within a social context. It offers a powerful blend of practical tools and insightful critique, providing an accessible pathway to financial mastery for anyone who feels disempowered by or disconnected from traditional financial guidance. Its engaging voice and relevant subject matter make it a compelling and valuable resource.

Get Rich, Lucky Bitch: Release Your Money Blocks and Live a First Class Life

"Get Rich, Lucky Bitch" by Denise Duffield-Thomas explores the concept of "money blocks"—deep-seated limiting beliefs and societal conditioning that prevent individuals, particularly women, from achieving financial abundance. It guides readers through identifying and overcoming these psychological barriers, reframing their relationship with money to attract prosperity and live a more luxurious life on their own terms. The book emphasizes mindset shifts, practical exercises, and cultivating an "abundance mindset" rather than solely focusing on traditional budgeting or investment strategies.

This book shares fundamental similarities with Kumiko Love's "My Money My Way" because both empower individuals to take active control of their financial destinies by addressing underlying behavioral and psychological factors. While Love focuses on individualized budgeting and conscious spending, Duffield-Thomas delves into the subconscious beliefs that often sabotage financial efforts, regardless of the practical systems in place. Both advocate for a personalized, empowering approach to money that goes beyond conventional advice.

The book will appeal to those seeking a transformative approach to their finances beyond standard financial planning. Its value lies in offering practical strategies for dismantling self-limiting beliefs about money, fostering a sense of deservingness, and leveraging mindset to attract wealth. It provides a unique blend of personal development and financial empowerment, encouraging a proactive and positive re-evaluation of one's financial identity.

Get Rich, Lucky Bitch: Release Your Money Blocks and Live a First Class Life

"Get Rich, Lucky Bitch" by Denise Duffield-Thomas explores the concept of "money blocks"—deep-seated limiting beliefs and societal conditioning that prevent individuals, particularly women, from achieving financial abundance. It guides readers through identifying and overcoming these psychological barriers, reframing their relationship with money to attract prosperity and live a more luxurious life on their own terms. The book emphasizes mindset shifts, practical exercises, and cultivating an "abundance mindset" rather than solely focusing on traditional budgeting or investment strategies.

This book shares fundamental similarities with Kumiko Love's "My Money My Way" because both empower individuals to take active control of their financial destinies by addressing underlying behavioral and psychological factors. While Love focuses on individualized budgeting and conscious spending, Duffield-Thomas delves into the subconscious beliefs that often sabotage financial efforts, regardless of the practical systems in place. Both advocate for a personalized, empowering approach to money that goes beyond conventional advice.

The book will appeal to those seeking a transformative approach to their finances beyond standard financial planning. Its value lies in offering practical strategies for dismantling self-limiting beliefs about money, fostering a sense of deservingness, and leveraging mindset to attract wealth. It provides a unique blend of personal development and financial empowerment, encouraging a proactive and positive re-evaluation of one's financial identity.

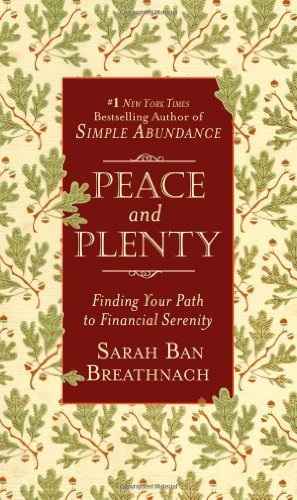

Peace and Plenty: Finding Your Path to Financial Serenity

"Peace and Plenty" explores a holistic approach to financial well-being, moving beyond mere budgeting to incorporate mindful consumption, gratitude, and intentional living. It guides individuals toward creating a personal philosophy that aligns their spending and saving with their deeply held values, fostering a sense of sufficiency and contentment regardless of net worth. The book emphasizes reducing financial anxiety through practices of simplicity and self-awareness.

This book shares a core philosophy with "My Money My Way" by focusing on the individual's agency and internal landscape in shaping their financial reality. Both titles advocate for defining one's own relationship with money, rather than blindly following external societal pressures. They empower the reader to personalize their financial journey, recognizing that true abundance isn't solely about accumulation but about alignment and mindful choice.

The book will appeal to those seeking not just financial stability, but also emotional peace surrounding their money. It offers practical wisdom for cultivating a sense of abundance and contentment, even amidst financial challenges, making it invaluable for anyone desiring a more serene and intentional approach to their finances than traditional, restrictive budgeting methods often provide.

Peace and Plenty: Finding Your Path to Financial Serenity

"Peace and Plenty" explores a holistic approach to financial well-being, moving beyond mere budgeting to incorporate mindful consumption, gratitude, and intentional living. It guides individuals toward creating a personal philosophy that aligns their spending and saving with their deeply held values, fostering a sense of sufficiency and contentment regardless of net worth. The book emphasizes reducing financial anxiety through practices of simplicity and self-awareness.

This book shares a core philosophy with "My Money My Way" by focusing on the individual's agency and internal landscape in shaping their financial reality. Both titles advocate for defining one's own relationship with money, rather than blindly following external societal pressures. They empower the reader to personalize their financial journey, recognizing that true abundance isn't solely about accumulation but about alignment and mindful choice.

The book will appeal to those seeking not just financial stability, but also emotional peace surrounding their money. It offers practical wisdom for cultivating a sense of abundance and contentment, even amidst financial challenges, making it invaluable for anyone desiring a more serene and intentional approach to their finances than traditional, restrictive budgeting methods often provide.

We Should All Be Millionaires: A Woman’s Guide to Earning More, Building Wealth, and Gaining Economic Power

"We Should All Be Millionaires" by Rachel Rodgers is a powerful call to action for women to aggressively pursue wealth accumulation and economic independence. It dismantles societal norms that often limit women's financial aspirations, offering practical strategies to increase income, build robust financial portfolios, and leverage wealth for personal empowerment and broader societal change. Rodgers emphasizes a mindset shift from scarcity to abundance, encouraging bold ambition in financial pursuits.

This book shares significant common ground with Kumiko Love's "My Money My Way." Both titles champion the idea of individuals, particularly women, seizing control of their financial destinies. They advocate for intentional financial planning, wealth-building, and challenging conventional narratives around money. Both authors empower their audience to define their own financial success and develop actionable plans to achieve it, focusing on practical steps to foster financial freedom and agency.

This book will resonate deeply with those seeking to transform their financial lives through an empowering, proactive approach. It provides not just theoretical frameworks but actionable advice on earning more, strategic investing, and overcoming obstacles to wealth. Its emphasis on economic power and societal impact offers a compelling reason to engage with its principles and apply them for significant personal and collective benefit.

We Should All Be Millionaires: A Woman’s Guide to Earning More, Building Wealth, and Gaining Economic Power

"We Should All Be Millionaires" by Rachel Rodgers is a powerful call to action for women to aggressively pursue wealth accumulation and economic independence. It dismantles societal norms that often limit women's financial aspirations, offering practical strategies to increase income, build robust financial portfolios, and leverage wealth for personal empowerment and broader societal change. Rodgers emphasizes a mindset shift from scarcity to abundance, encouraging bold ambition in financial pursuits.

This book shares significant common ground with Kumiko Love's "My Money My Way." Both titles champion the idea of individuals, particularly women, seizing control of their financial destinies. They advocate for intentional financial planning, wealth-building, and challenging conventional narratives around money. Both authors empower their audience to define their own financial success and develop actionable plans to achieve it, focusing on practical steps to foster financial freedom and agency.

This book will resonate deeply with those seeking to transform their financial lives through an empowering, proactive approach. It provides not just theoretical frameworks but actionable advice on earning more, strategic investing, and overcoming obstacles to wealth. Its emphasis on economic power and societal impact offers a compelling reason to engage with its principles and apply them for significant personal and collective benefit.

The Total Money Makeover Workbook

"The Total Money Makeover Workbook" guides individuals through a structured process to eliminate debt and build financial stability. It emphasizes seven "Baby Steps," starting with a small emergency fund and progressing through debt payoff using the "debt snowball" method, saving for a down payment, investing, and giving. This workbook provides practical exercises and templates to help users implement Ramsey's system.

This workbook shares a core similarity with "My Money My Way": both empower individuals to actively manage their finances and break free from debt. While Love focuses on a more personalized, intuitive approach to money management, Ramsey offers a rigid, step-by-step methodology, but the overarching goal of financial liberation and control remains consistent. Both aim to transform financial habits and provide actionable strategies.

The structured, actionable nature of "The Total Money Makeover Workbook" will appeal to many. Its clear-cut steps and practical exercises offer a tangible path for those feeling overwhelmed by debt. The emphasis on quick wins through the debt snowball provides powerful motivation, and the workbook format ensures active engagement, making it a valuable tool for anyone committed to overhauling their financial situation.

The Total Money Makeover Workbook

"The Total Money Makeover Workbook" guides individuals through a structured process to eliminate debt and build financial stability. It emphasizes seven "Baby Steps," starting with a small emergency fund and progressing through debt payoff using the "debt snowball" method, saving for a down payment, investing, and giving. This workbook provides practical exercises and templates to help users implement Ramsey's system.

This workbook shares a core similarity with "My Money My Way": both empower individuals to actively manage their finances and break free from debt. While Love focuses on a more personalized, intuitive approach to money management, Ramsey offers a rigid, step-by-step methodology, but the overarching goal of financial liberation and control remains consistent. Both aim to transform financial habits and provide actionable strategies.

The structured, actionable nature of "The Total Money Makeover Workbook" will appeal to many. Its clear-cut steps and practical exercises offer a tangible path for those feeling overwhelmed by debt. The emphasis on quick wins through the debt snowball provides powerful motivation, and the workbook format ensures active engagement, making it a valuable tool for anyone committed to overhauling their financial situation.

Pirates of Financial Freedom

"Pirates of Financial Freedom" by Joey Fehrman explores the concept of achieving financial independence through strategic planning and unconventional approaches, urging individuals to challenge traditional financial norms. It advocates for taking proactive control of one's money, emphasizing practical steps like budgeting, debt reduction, and smart investing to build long-term wealth and secure freedom from financial burdens.

This book aligns with Kumiko Love's "My Money My Way" by focusing on the individual's agency in their financial journey. Both titles empower readers to actively manage their finances, moving away from passive acceptance towards intentional action. The core message in both is about reclaiming control and forging a personalized path to financial well-being, rather than simply following conventional, often restrictive, financial advice.

The book will resonate with anyone feeling overwhelmed or underserved by traditional financial guidance. It offers a fresh, empowering perspective on wealth building, providing actionable strategies that can be implemented regardless of one's current financial situation. Its value lies in demystifying finance, offering a clear roadmap to financial autonomy, and inspiring readers to become the architects of their own economic destiny.

Pirates of Financial Freedom

"Pirates of Financial Freedom" by Joey Fehrman explores the concept of achieving financial independence through strategic planning and unconventional approaches, urging individuals to challenge traditional financial norms. It advocates for taking proactive control of one's money, emphasizing practical steps like budgeting, debt reduction, and smart investing to build long-term wealth and secure freedom from financial burdens.

This book aligns with Kumiko Love's "My Money My Way" by focusing on the individual's agency in their financial journey. Both titles empower readers to actively manage their finances, moving away from passive acceptance towards intentional action. The core message in both is about reclaiming control and forging a personalized path to financial well-being, rather than simply following conventional, often restrictive, financial advice.

The book will resonate with anyone feeling overwhelmed or underserved by traditional financial guidance. It offers a fresh, empowering perspective on wealth building, providing actionable strategies that can be implemented regardless of one's current financial situation. Its value lies in demystifying finance, offering a clear roadmap to financial autonomy, and inspiring readers to become the architects of their own economic destiny.

Moolala: Why Smart People Do Dumb Things with Their Money - and What You Can Do About It

"Moolala" by Bruce Sellery delves into the psychological underpinnings of our financial decisions. It explores why intelligent individuals often make irrational choices with their money, examining common behavioral biases and emotional triggers that lead to poor financial outcomes. Sellery then offers practical, actionable strategies to recognize these traps and develop healthier money habits.

Both "Moolala" and "My Money My Way" share a core focus on empowering individuals through self-awareness and practical financial management. While Kumiko Love champions a personalized, control-oriented approach, Sellery similarly emphasizes understanding one's financial behavior to assert greater control. Both books move beyond purely mechanical budgeting to address the deeper reasons behind our money struggles.

This book will resonate with anyone seeking to improve their financial well-being by understanding the "why" behind their spending and saving patterns. It offers valuable insights and concrete tools for overcoming common financial pitfalls, ultimately leading to more informed and intentional monetary choices. The emphasis on behavioral finance provides a fresh perspective for those who have struggled with traditional budgeting advice.

Moolala: Why Smart People Do Dumb Things with Their Money - and What You Can Do About It

"Moolala" by Bruce Sellery delves into the psychological underpinnings of our financial decisions. It explores why intelligent individuals often make irrational choices with their money, examining common behavioral biases and emotional triggers that lead to poor financial outcomes. Sellery then offers practical, actionable strategies to recognize these traps and develop healthier money habits.

Both "Moolala" and "My Money My Way" share a core focus on empowering individuals through self-awareness and practical financial management. While Kumiko Love champions a personalized, control-oriented approach, Sellery similarly emphasizes understanding one's financial behavior to assert greater control. Both books move beyond purely mechanical budgeting to address the deeper reasons behind our money struggles.

This book will resonate with anyone seeking to improve their financial well-being by understanding the "why" behind their spending and saving patterns. It offers valuable insights and concrete tools for overcoming common financial pitfalls, ultimately leading to more informed and intentional monetary choices. The emphasis on behavioral finance provides a fresh perspective for those who have struggled with traditional budgeting advice.

Financial Peace Revisited: New Chapters on Marriage, Singles, Kids and Families

"Financial Peace Revisited" by Dave Ramsey offers a comprehensive, principles-based approach to personal finance, emphasizing debt elimination, saving, and wealth building. It addresses specific financial challenges and opportunities encountered across different life stages and family structures, from single individuals to married couples and parents, providing actionable strategies for each.

This book shares a core philosophy with "My Money My Way": empowering individuals to take active control of their financial destinies. Both authors prioritize practical, step-by-step guidance over complex jargon, aiming to demystify personal finance and make it accessible. They champion a proactive mindset, encouraging readers to build sustainable habits that lead to long-term financial security and freedom.

The book's appeal lies in its clear, actionable framework for achieving financial stability and independence. Its focus on practical application, coupled with specific advice tailored to various family dynamics, provides tangible solutions for common financial hurdles. The emphasis on intentional financial planning and disciplined execution will prove valuable for anyone seeking a structured path to improved financial health and peace of mind.

Financial Peace Revisited: New Chapters on Marriage, Singles, Kids and Families

"Financial Peace Revisited" by Dave Ramsey offers a comprehensive, principles-based approach to personal finance, emphasizing debt elimination, saving, and wealth building. It addresses specific financial challenges and opportunities encountered across different life stages and family structures, from single individuals to married couples and parents, providing actionable strategies for each.

This book shares a core philosophy with "My Money My Way": empowering individuals to take active control of their financial destinies. Both authors prioritize practical, step-by-step guidance over complex jargon, aiming to demystify personal finance and make it accessible. They champion a proactive mindset, encouraging readers to build sustainable habits that lead to long-term financial security and freedom.

The book's appeal lies in its clear, actionable framework for achieving financial stability and independence. Its focus on practical application, coupled with specific advice tailored to various family dynamics, provides tangible solutions for common financial hurdles. The emphasis on intentional financial planning and disciplined execution will prove valuable for anyone seeking a structured path to improved financial health and peace of mind.

More Books to Explore

Discover more titles that expand on these ideas and themes.

Debt-Free Forever: Take Control of Your Money and Your Life

Easy Money Management: A Give and Save 3-6-5 Approach to Personal Finance

Financial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You Love

Get Rich, Lucky Bitch: Release Your Money Blocks and Live a First Class Life

Peace and Plenty: Finding Your Path to Financial Serenity

We Should All Be Millionaires: A Woman’s Guide to Earning More, Building Wealth, and Gaining Economic Power